El Museo de Arte Tigre (MAT) es uno de los más relevantes de la Argentina. Su particular atractivo combina el valor histórico y arquitectónico de su edificio, el significativo patrimonio de su colección y la intensa actividad de muestras, ciclos, talleres y espectáculos que realiza.

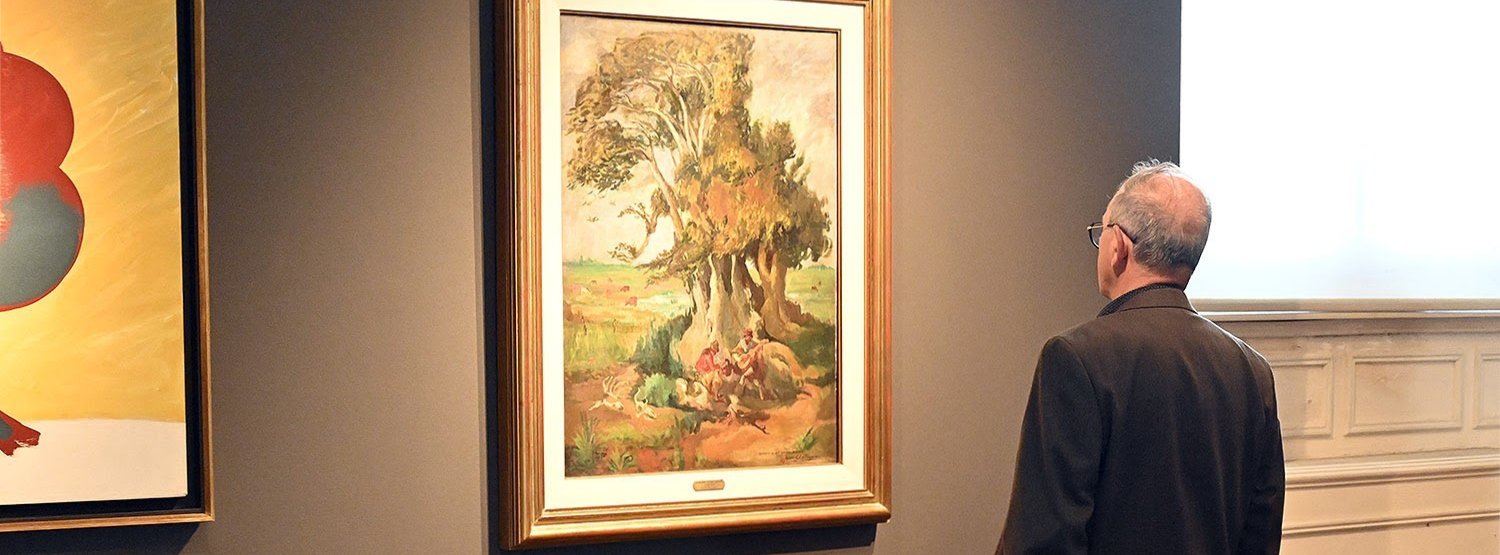

Las obras de su patrimonio permiten recorrer la historia de la plástica en la Argentina, desde sus comienzos hasta el presente, a través de sus artistas más representativos: Rugendas, Della Valle, Pallière, Sívori, Quirós, Butler, Fader, Quinquela Martin, Spilimbergo, Berni, Soldi, Castagino, Alonso, son solo algunas de las firmas más reconocidas de una colección que se amplía de manera constante con nuevas adquisiciones.

A ello se suman las muestras y exposiciones temporarias, acompañadas de visitas guiadas y talleres especialmente organizados para chicos, que así pueden disfrutar de una experiencia creativa. Cursos, espectáculos, ciclos de poesía y de música, talleres y una variada agenda de actividades de extensión hacen del MAT un legítimo orgullo, para Tigre y para la cultura argentina.

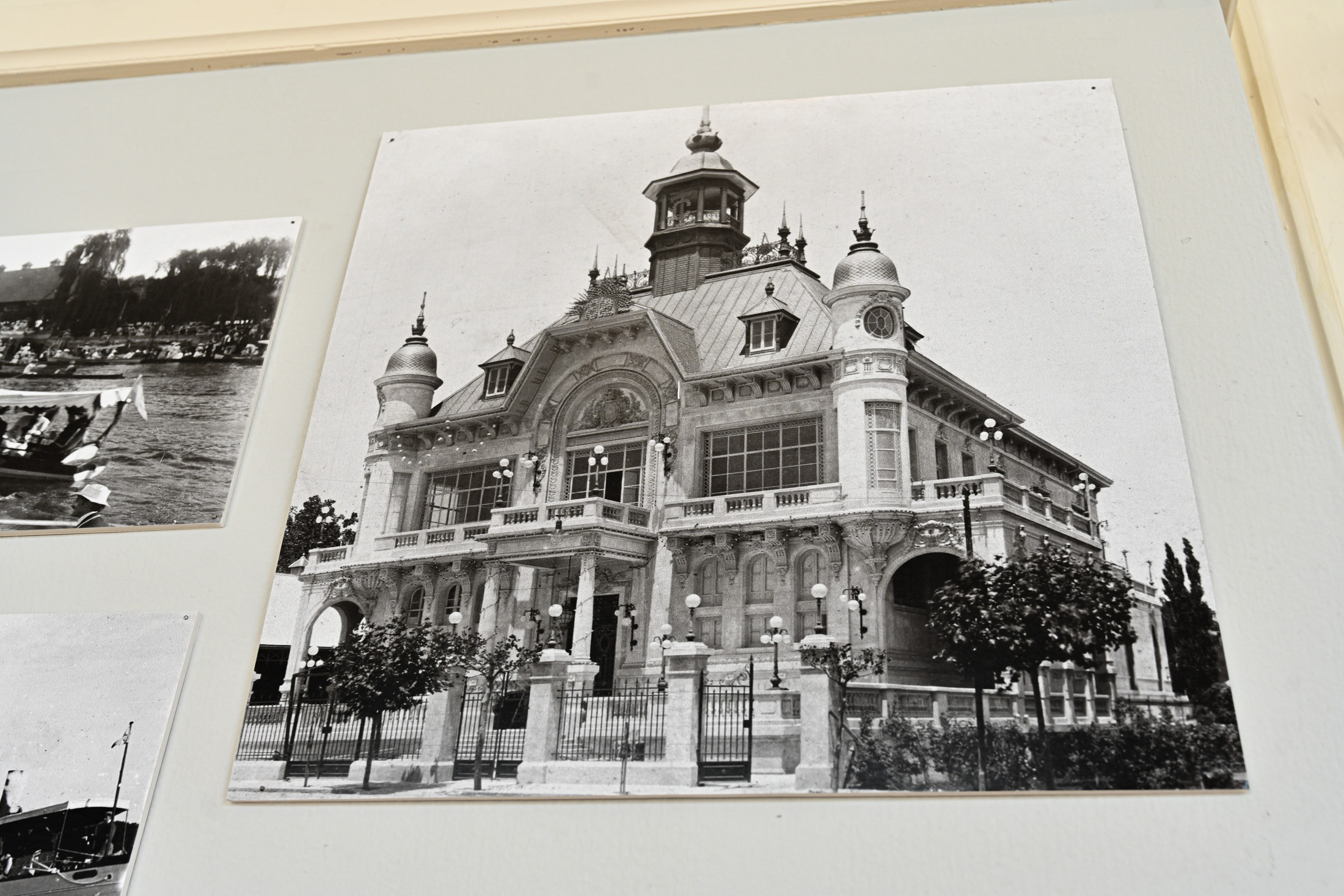

En 2006 el Museo de Arte Tigre (MAT) abrió sus puertas al público. Funciona en un edificio histórico del Delta, el ex Tigre Club, patrimonio histórico nacional y municipal.

El MAT, desde su creación, es un importante atractivo cultural pensado y fundado por el intendente Ricardo Ubieto (1933-2006) quien involucró a toda la comunidad de Tigre en el proyecto.

En su decreto fundacional expresa: "…su colección se integrará con las obras más representativas del arte argentino, comprendidas entre los siglos XIX y XX. Resaltando aquellas expresiones de carácter figurativo que reflejen, con claridad, imágenes relativas a los tipos y costumbres de nuestro país y de las comunidades que forjaron la Nación incluyendo sus paisajes y tradiciones. Priorizando, en todos los casos, el más alto nivel de calidad artística, acorde al ámbito de excelencia que debe ser propio de una institución museológica".

Continuar leyendo

Así es como la particular geografía de Tigre y sus costumbres se recrean en obras de artistas que nos visitaron en el siglo XIX, como el francés Juan León Pallière: un viajero que documentó la vida en las islas del Paraná y los exóticos paisajes, apreciados a través de sus ojos de extranjero. A comienzos del XX el muralista italiano Carlos Barberis, afincado en la Argentina, pintó iglesias a la par que apacibles visiones del Delta. Otros artistas más contemporáneos, como Horacio Butler, Jorge Larco y Fermín Eguía, que vivieron en Tigre y lo plasmaron, también forman parte de su acervo.

Además están presentes maestros de otro río: El Riachuelo, ellos son los de la prestigiosa escuela de La Boca. Este grupo, fuertemente influido por la inmigración italiana, está presente en el museo a través de las obras del pionero Alfredo Lázzari, Víctor Cúnsolo, Eugenio Daneri, Fortunato Lacámera, Marcos Tiglio, Miguel Diomede, Benito Quinquela Martín y Miguel Carlos Victorica.

Otra sección de la colección del siglo XIX reúne acuarelas, óleos y litografías que son parte de las primeras imágenes del arte rioplatense. Tales son las obras de Carlos Enrique Pellegrini, el ya mencionado Juan León Pallière, Juan Mauricio Rugendas y José Aguyari, que registran escenas urbanas y rurales desde la mirada romántica, persiguiendo lo característico de cada lugar y su pintoresquismo. De los artistas argentinos que se formaron en Europa e introdujeron la pintura académica y el modelo vivo encontramos la llamada Generación del 80. El MAT posee notables piezas de Eduardo Sívori, Ángel Della Valle, Antonio Alice y Graciano Mendilaharzu.

Del grupo Nexus (1905-1907), las obras de Fernando Fader, Cesáreo Bernaldo de Quirós, Carlos Ripamonte, Pío Collivadino y Justo Lynch muestran como estos artistas, actuantes en los años previos a los festejos del primer Centenario de la Revolución de Mayo, percibían en el paisaje la evidencia y el carácter particular de la identidad nacional.

Del período comprendido entre la década de 1920 y la actualidad, la colección reúne importantes pinturas de Norah Borges, Valentín Thibon de Libian, Lino Enea Spilimbergo, Santiago Cogorno, Antonio Berni, Raúl Soldi, Juan Carlos Castagnino, Carlos Alonso y Raquel Forner, entre otros.

El museo ha formado también una interesante fototeca de artistas contemporáneos, dedicada solamente a escenas del Tigre y el Delta, así como también fue incrementando su patrimonio con esculturas, muchas de ellas emplazadas en los jardines. Se destaca Mujer con libro de José Fioravanti. La programación de exhibiciones temporarias se centra en muestras cuya temática se relacione con el delta y sus alrededores.

Los comienzos

Artistas como Juan Mauricio Rugendas, Carlos Enrique Pellegrini y Graciano Mendilaharzu nos presentan a la Argentina.

Tigre histórico

Recorrido fotográfico sobre la historia de Tigre y su antiguo Tigre Club.

La primera metáfora es el río

En esta sala reunimos obras de distintas épocas, pasado y presente conviven en los trabajos de diferentes artistas de la colección para mostrarnos que el magnetismo hacia este incomparable lugar permanece en el tiempo.

Páez Vilaró: candombes y puertos. Escenas del Río de la Plata

La exposición que homenajea al artista y vecino consta de 22 piezas que reflejan el candombe uruguayo y escenas portuarias de Tigre.

Donación Guillermo Jaim Etcheverry

Se destacan artistas como Battle Planas, Tiglio, Quinquela Martín, Gerstein, Diomede, Russo, Aizenberg, por mencionar algunos.

Paisajes

El grupo de artistas reunido en esta sala, identificó a la región de las sierras como símbolo del paisaje nacional, de esta manera el paisaje dejó de ser simplemente un género para ser el punto de partida de la identidad de nuestra nación.

Cómo llegar al MAT

En tren: Línea Mitre, desde estación Belgrano hacia estación Tigre (final del recorrido). Caminata por Av. Victorica hasta Av. Victorica 972.

Colectivo (bus): 60F, 60I, 60M, 60N, 721B, desde Av. Cazón hasta Av. Liniers y Tedin.

Horarios

El Museo de Arte Tigre permanece abierto al público de miércoles a viernes de 13:00 a 18:00 hs y los sábados, domingos y feriados de 12:00 a 18:00 hs. La boletería cierra a las 17:30 hs.

Visita guiada

Contamos con personal de educación y visitas guiadas en distintos horarios; estas son los días miércoles, jueves y viernes a las 16:30 hs y los sábados, domingos y feriados a las 13:30 hs y 16:30 hs.

Valor de la entrada

Entrada general: $5100 pesos

DNI con domicilio en Tigre: Gratis

Menores de 12 años: Gratis

Personas con discapacidad y jubilados con acreditación: Gratis

Medios de pago: Efectivo, tarjetas de débito y crédito.

Correo electrónico: infomuseo@tigre.gob.ar

Teléfono: +54 11 2184 1205 (atención de lunes a viernes de 09:00 a 15:00 hs)